Loading

Get Rev 717

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rev 717 online

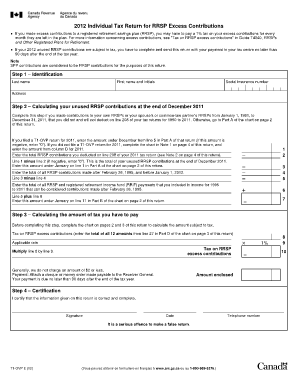

The Rev 717 form is essential for reporting excess contributions made to your registered retirement savings plan (RRSP). This guide provides a detailed, step-by-step process to help you fill out the form accurately and efficiently.

Follow the steps to successfully complete the Rev 717 online.

- Click ‘Get Form’ button to access the Rev 717 form and open it in your chosen editor.

- Begin by entering your identification information. Fill in your last name, first name and initials, social insurance number, and your complete address.

- Proceed to calculate your unused RRSP contributions as of December 31, 2011. If you made contributions to your own or your partner's RRSPs during the relevant period, record the appropriate amounts in the designated fields.

- Complete the required calculations for the excess contribution tax. This includes filling out the chart on pages 2 and 3 to determine the tax owed based on total excessive contributions.

- Certify the information provided in the form by signing and dating the document. Ensure that all details are correct to avoid penalties or misreporting.

- Finalize your submission by saving the completed form. You will have options to download, print, or share your form as needed.

Complete your Rev 717 form online today to ensure compliance and avoid unnecessary taxes.

(a) Permanent residents. A permanent resident defined in § 38.3 (relating to definitions), is excluded from Hotel Occupancy Tax liability upon the occupancy of any room or rooms in a hotel for any rental period during which, or at the expiration of which, he is or becomes a permanent resident.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.