Loading

Get Pa Inheritance Tax Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pa Inheritance Tax Form online

Filling out the Pa Inheritance Tax Form is an important step in managing the estate of a deceased individual. This guide will provide clear instructions to help users complete the form efficiently and accurately, ensuring compliance with Pennsylvania tax regulations.

Follow the steps to fill out the Pa Inheritance Tax Form online

- Click ‘Get Form’ button to obtain the form and open it in your preferred digital format.

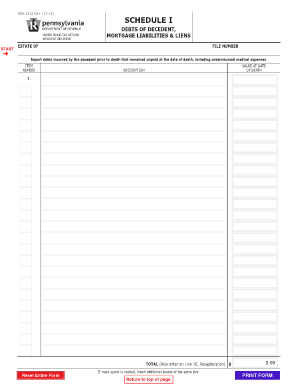

- Enter the estate name in the ‘Estate of’ field, indicating the full name of the deceased individual whose estate is being reported.

- Input the file number in the designated section. This number may be assigned to the estate for tracking purposes.

- Proceed to the debts of the decedent section. Report debts incurred by the decedent prior to death that remained unpaid at the date of death, including any unreimbursed medical expenses.

- For each debt, fill in the item number and provide a description of the debt in the description field. Clearly list the value at the date of death for each debt item.

- Calculate the total value of the debts reported and enter the amount on Line 10, Recapitulation, as indicated. Ensure all calculations are accurate to reflect the total liabilities.

- If additional space is needed for more debts, insert additional sheets of the same size to continue reporting necessary information.

- Once all sections are completed, review the form for accuracy. You can then save changes, download, print, or share the form as necessary.

Complete your Pa Inheritance Tax Form online today to stay compliant with estate management requirements.

An inheritance tax return must be filed for every decedent who has property which is or may be subject to tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.