Loading

Get How To Answer A Lawsuit For Debt Collection - Educationcenter2000.com

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How To Answer A Lawsuit For Debt Collection - Educationcenter2000.com online

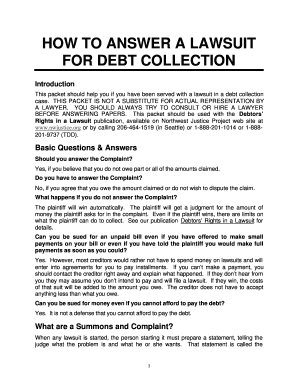

If you have received a lawsuit regarding debt collection, it is crucial to respond appropriately. This guide assists you in understanding the steps to complete the How To Answer A Lawsuit For Debt Collection form online, ensuring you protect your rights and present your case effectively.

Follow the steps to fill out the form correctly.

- Press the ‘Get Form’ button to access the form and open it in your preferred editing software.

- Review the form thoroughly to understand each section and its requirements.

- Begin by completing the caption section at the top of the page. This includes the name of the court, your name, the plaintiff's name, and the case number.

- Proceed to the admissions/denials section. Respond to each statement in the complaint by admitting, denying, or expressing lack of knowledge.

- Identify any defenses you may have against the claims made in the complaint and include them in your answer.

- If applicable, state any counterclaims you have against the plaintiff related to the same transaction.

- Incorporate any information about exempt income that may be relevant to the case.

- Complete the signature section by adding your signature, printed name, and address to ensure the document is recognized.

- Make at least two copies of your completed answer and, if applicable, the notice of appearance.

- Deliver one copy to the plaintiff's lawyer or the plaintiff directly and ensure you obtain proof of delivery.

- File the original answer with the court clerk before the deadline indicated in your summons.

- Consider mailing additional copies to ensure relevance and provide timely responses, using certified mail if possible.

Start filling out your document online today to ensure you respond on time!

Debt cases filed in a Texas JP/Justice Court have a deadline of 14 days after the summons is served. If you were served with a summons, but do not file an answer before the deadline, the judge will issue a default judgment against you. ... That's why it's important to file your response before the deadline.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.