Loading

Get Loan Modification Agreement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Loan Modification Agreement online

Filling out the Loan Modification Agreement can be straightforward when you follow a structured approach. This guide will provide you with clear instructions to help you complete the form accurately and efficiently, ensuring that your loan modification process is smooth.

Follow the steps to fill out the Loan Modification Agreement online effectively.

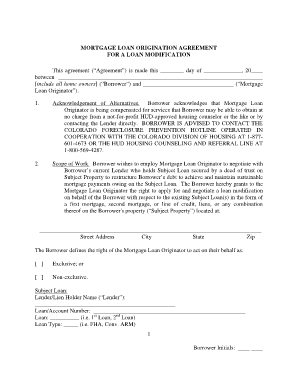

- Use the ‘Get Form’ button to obtain the Loan Modification Agreement and open it in your preferred editor.

- Begin by entering the date you are completing the agreement in the designated blank area.

- Identify all borrowers involved in the agreement by entering their names in the provided space.

- Fill in the name of the Mortgage Loan Originator in the corresponding section of the form.

- Acknowledge the alternatives by selecting whether you are aware of the free services offered by HUD-approved counselors.

- Clearly describe the scope of work by indicating how you wish the Mortgage Loan Originator to negotiate with your lender.

- Complete the section detailing your Subject Property by entering the complete address including street, city, state, and zip code.

- Specify whether the Mortgage Loan Originator will have exclusive or non-exclusive rights to represent you.

- Provide details about the Subject Loan, including Lender name, Loan/Account number, Loan type, and any specific terms you desire for your loan modification.

- Attach the completed Colorado Tangible Net Benefit Disclosure Form and any other required documents.

- Review your obligations as a borrower, ensuring you can provide all necessary documentation within the required timeframe.

- Sign and date the document at the end, ensuring that all required parties do the same.

- Once all sections are completed, you can save your changes, download, print, or share the Loan Modification Agreement as needed.

Get started on completing your Loan Modification Agreement online today!

No matter how focused your attention to detail, your credit score almost certainly will take a hit with a home loan modification. Often, a homeowner won't get approved for a loan modification unless there is evidence of one or several missed payments. Those missed payments hurt your credit score.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.