Loading

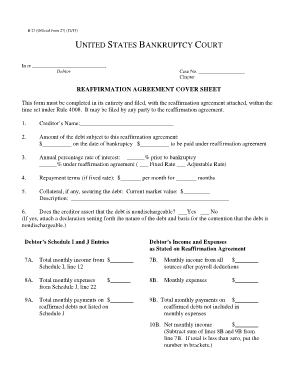

Get Reaffirmation Agreement Cover Sheet - U.s. Courts - Uscourts

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Reaffirmation Agreement Cover Sheet - U.S. Courts - Uscourts online

Completing the Reaffirmation Agreement Cover Sheet is an important step in the bankruptcy process. This guide provides clear instructions for users to effectively fill out this form online, ensuring that all necessary information is accurately captured.

Follow the steps to successfully fill out the Reaffirmation Agreement Cover Sheet.

- Click ‘Get Form’ button to obtain the Reaffirmation Agreement Cover Sheet and open it in the document management editor.

- Enter the creditor’s name in the designated field, ensuring that you accurately reflect the name of the individual or organization to whom the debt is owed.

- Provide the amount of the debt subject to the reaffirmation agreement. Fill in the amount as of the date of bankruptcy and the amount to be paid under the reaffirmation agreement.

- Indicate the annual percentage rate of interest prior to bankruptcy and under the reaffirmation agreement. Select whether the rate is fixed or adjustable.

- For fixed-rate agreements, specify the repayment terms by entering the monthly payment amount and the number of months to complete the repayment.

- If applicable, describe any collateral securing the debt and provide its current market value.

- Answer whether the creditor asserts that the debt is nondischargeable. If yes, ensure to attach a declaration to your submission.

- Fill out the debtor's income and expenses by entering the total monthly income and monthly income from all sources after payroll deductions.

- Enter the total monthly expenses based on the schedules provided and ensure to compare these figures with those listed in your Schedule J.

- Explain any differences between reported income and expenses in the specific fields provided. This explanation is crucial if you make any entries in these lines.

- If the total monthly payments on reaffirmed debts exceed the income, check the appropriate box and explain how you plan to meet these payments.

- Confirm whether you were represented by counsel during the negotiation of the reaffirmation agreement and ensure that any necessary certifications are included.

- Once all fields are complete, save your changes, download a copy, print the form, or share it as needed.

Complete your reaffirmation agreement cover sheet online today for a smoother filing process.

In Chapter 7 bankruptcy, you can keep property secured by collateral (such as your car) by reaffirming the debt. ... Reaffirmation is the process wherein you agree to remain responsible for a debt so that you can keep the property securing the debt (collateral).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.