Loading

Get This Return Is

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the This Return Is online

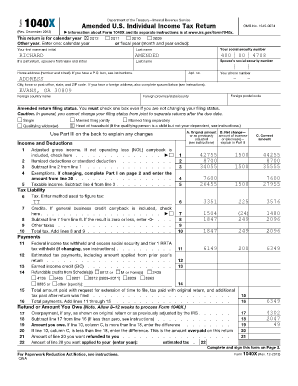

Filling out the This Return Is (Form 1040X) online is a straightforward process designed to help you amend your U.S. Individual Income Tax Return. This guide will provide you with step-by-step instructions to ensure you complete the form accurately and effectively.

Follow the steps to complete the Form 1040X online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your first name and initial in the designated field, followed by your last name.

- Provide your social security number carefully in the corresponding box.

- If applicable, fill in your spouse’s first name and initial, last name, and their social security number.

- Complete your home address, including the city, state, and ZIP code. If you have a foreign address, ensure you fill out the additional foreign address fields.

- Indicate your filing status by checking the appropriate box for amended return status.

- Complete the Income and Deductions section by providing the necessary figures for adjusted gross income, deductions, and taxable income.

- Move on to the Tax Liability section, including how tax was calculated and listing any applicable credits.

- Fill out the Payments section, entering any federal income tax withheld, estimated payments, and refundable credits.

- In the Refund or Amount You Owe section, calculate the overpayment or amount owed based on the provided lines.

- If applicable, complete Part I for Exemptions, detailing any changes to the number of exemptions.

- Complete Part III by providing an explanation for your amendments and attach any necessary supporting documents.

- Finally, ensure to sign the form and note the date. Your spouse must also sign if it is a joint return.

- Save your changes, download, print, or share the completed form as needed.

Complete your tax documents online today for a smoother filing experience.

Rejection or acceptance usually happens within 24 - 48 hours.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.