Loading

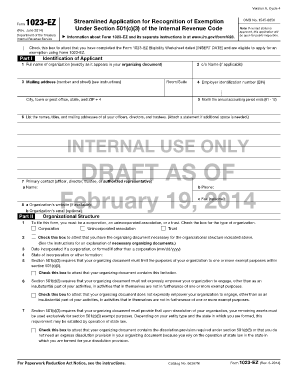

Get Form 1023-ez (rev. June 2014). Internal Revenue Code 501(c)(3) Streamline Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1023-EZ (Rev. June 2014). Internal Revenue Code 501(c)(3) Streamline Application Form online

Filling out the Form 1023-EZ is an essential step for organizations seeking tax-exempt status under section 501(c)(3). This guide provides comprehensive instructions to help users navigate the form's components and complete it accurately.

Follow the steps to successfully complete the Form 1023-EZ online.

- Press the ‘Get Form’ button to obtain the Form 1023-EZ and open it in your preferred editing tool.

- In Part I, provide the identification details of your organization. Fill in the full name of the organization, mailing address, and employer identification number (EIN), ensuring accuracy.

- Identify the organizational structure in Part II. Check the appropriate box for whether you are a corporation, unincorporated association, or trust, and provide the date and state of incorporation.

- Continue in Part II by attesting to the contents of your organizing document. Confirm that it limits purposes to section 501(c)(3) exempt purposes and contains a dissolution provision.

- In Part III, indicate the activities your organization will undertake. Enter the appropriate NTEE Code and check all applicable charitable purposes that your organization will support.

- Review and attest that your organization adheres to the restrictions outlined in Part III. Confirm you will not support political candidates or engage in prohibited activities.

- In Part IV, classify your organization as a private foundation or public charity. Check the relevant box and provide the necessary attestations.

- Complete Part V by providing information related to the user fee, if applicable.

- Finalize your application in Part VI. The authorized signer should declare the application is true and correct, then sign and date it.

- After completing the form, review it thoroughly for any errors. Users can save changes, download, print, or share the completed Form 1023-EZ as needed.

Start completing your Form 1023-EZ online today to pursue your organization's tax-exempt status.

You can download copies of original determination letters (issued January 1, 2014 and later) using our on-line search tool Tax Exempt Organization Search (TEOS). It may take 60 days or longer to process your request. You may also request an affirmation letter.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.