Loading

Get Transaction Privilege And Use Tax Return - City Of Scottsdale - Scottsdaleaz

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Transaction Privilege And Use Tax Return - City Of Scottsdale - Scottsdaleaz online

Completing the Transaction Privilege and Use Tax Return for the City of Scottsdale online is a straightforward process. This guide will provide you with step-by-step instructions on how to accurately fill out the form, ensuring you meet all necessary requirements.

Follow the steps to complete your tax return accurately.

- Click ‘Get Form’ button to access the Transaction Privilege and Use Tax Return form.

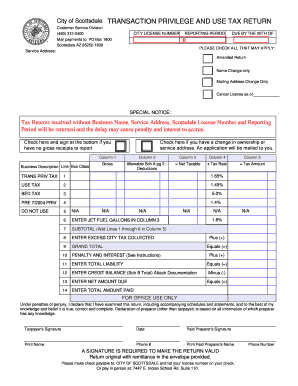

- Begin by entering your city license number and the reporting period at the top of the form. Make sure these details match the preprinted information that is typically sent to you.

- Indicate whether the return is an amended return, name change, mailing address change, or canceling the license by checking the appropriate boxes.

- In the 'Gross Receipts' section, enter the total gross income, including tax collected, applicable to your taxable activity.

- Populate the 'Total Deductions' field with the total itemized deduction amounts as instructed on the second page.

- Calculate the 'Net Taxable' amount by subtracting the total deductions from gross receipts.

- Complete the tax calculation by multiplying the Net Taxable amount by the appropriate tax rate for each line item in the taxable activity as provided on the form.

- Enter any excess city tax collected, if applicable, and compute the grand total tax due by adding the subtotal and the excess tax.

- Fill in any penalties and interest as noted in the instructions, then calculate your total tax liability.

- Finally, enter any credit balances and the net amount due after deducting any credits. Ensure your form is signed and dated.

- After completing the form, proceed to save your changes. You may then download, print, or share the form as required.

Complete your Transaction Privilege and Use Tax Return online today to ensure timely filing and compliance with city regulations.

Related links form

Rather than a tax on a sale paid by the buyer, TPT is a tax for “the privilege of doing business” in the state of Arizona and levied on the seller. In Arizona, a seller is responsible for remitting TPT whether or not they actually collect TPT on a transaction.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.