Loading

Get Iht100d

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iht100d online

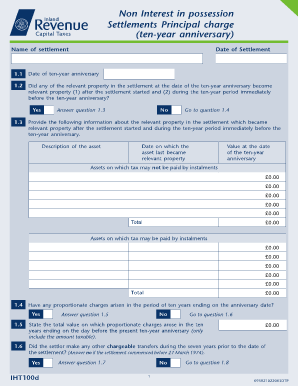

The Iht100d form is essential for reporting details relevant to settlement charges and capital taxes. This guide provides step-by-step instructions to help users, regardless of their experience level, complete the form accurately and effectively online.

Follow the steps to complete the Iht100d form online with ease.

- Press the ‘Get Form’ button to access the Iht100d form and open it in your preferred editor.

- Begin by entering the name of the settlement in the designated field.

- Input the date of the settlement, using the provided date format.

- Next, enter the date of the ten-year anniversary of the settlement. This is crucial for tax reporting.

- Respond to question 1.2 by specifying whether any of the relevant property became relevant after the start of the settlement and during the ten-year period before the anniversary.

- If applicable, describe the asset that became relevant property after the settlement started, along with the date it became relevant and its value at the ten-year anniversary.

- Report on assets for which tax may not be paid by instalments and total these amounts where required.

- Answer question 1.4 by indicating whether any proportionate charges arose before the ten-year anniversary.

- State the total taxable value on which proportionate charges arose as specified in question 1.5.

- Indicate if the settlor made any chargeable transfers in the seven years prior to the settlement's date.

- Provide answers for questions regarding chargeable transfers and their values as relevant to the settlement.

- Conclude by reviewing all entries made and ensuring they are accurate.

- Once you have filled out the form, you can choose to save changes, download, print, or share the completed Iht100d form.

Complete your Iht100d form online today for efficient management of your settlement charges.

10 year periodic chargeDiscretionary trusts are 'relevant property' trusts. Because the trust assets are not included in the taxable estate of any of the beneficiaries, the trust itself will be assessed to IHT every 10 years.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.