Loading

Get Co-signer Application - Hip - Holroyd Investment Properties

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

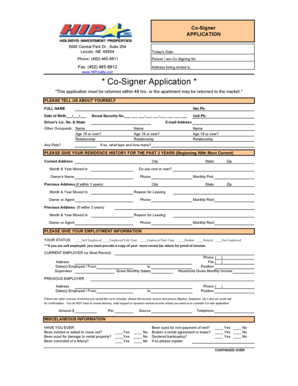

How to fill out the Co-Signer Application - HIP - Holroyd Investment Properties online

Filling out the Co-Signer Application for Holroyd Investment Properties is a straightforward process that helps ensure all necessary information is accurately provided. This guide will assist you in completing the form online, ensuring that you meet all requirements and provide relevant details efficiently.

Follow the steps to successfully complete your Co-Signer Application.

- Click the ‘Get Form’ button to access the Co-Signer Application and open it in an editor.

- Begin by entering your personal details in the 'Please tell us about yourself' section. Provide your full name, date of birth, phone number, driver's license number, and email address. Ensure all fields are filled accurately.

- In the following section, include details about the individual you are co-signing for. State their name, relationship to you, and if they are 19 years or older. Also, indicate if there are any pets and specify their type and number.

- Move to the 'Please give your residence history for the past 3 years' section. Begin with your current address, including city, state, and zip code, along with the month and year you moved in. Indicate whether you rent or own, and provide your landlord's name and contact information.

- Continue to add details of any previous addresses within the last three years, along with the corresponding dates and reasons for leaving. Be specific about the monthly rent and if applicable, the landlord or agent's contact information.

- Next, provide your employment information. Indicate your current employment status and provide details about your present and previous employers, including their addresses, your job titles, dates employed, and salary. If self-employed, attach a copy of your most recent tax return.

- In the miscellaneous information section, respond to the questions regarding any past eviction, legal issues, or bankruptcy. Be honest and provide explanations where necessary.

- Fill out the personal emergency notification section with contact details of a person you trust. Ensure you provide their relationship to you and their complete address.

- Review the application thoroughly for accuracy. Your signature and the date must be included at the end of the application to authorize submission.

- Once all information is entered and validated, you may save the changes, download the application, print it for your records, or share it as required.

Begin your Co-Signer Application online today and ensure all necessary documents are submitted promptly.

Typically, a cosigner needs a credit score of 670 or better to be approved. This range is usually classified as very good to excellent credit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.