Loading

Get Georgia Sales And Use Tax Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Georgia Sales And Use Tax Application Form online

Filling out the Georgia Sales and Use Tax Application Form online can be a straightforward process if you understand each component of the form. This guide provides clear and comprehensive instructions to ensure you can complete the application accurately and efficiently.

Follow the steps to successfully complete the Georgia Sales And Use Tax Application Form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

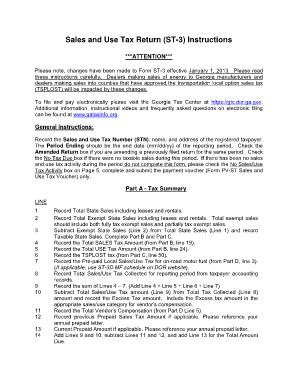

- Begin by entering your Sales and Use Tax Number, along with the name and address of the registered taxpayer. Make sure this information is accurate to avoid any delays.

- Fill in the 'Period Ending' field with the end date of your reporting period in the format mm/dd/yy. If you are amending a previously filed return, be sure to check the 'Amended Return' box.

- If there were no taxable sales during the reporting period, check the 'No Tax Due' box. If there has been no sales and use tax activity, you should check the 'No Sales/Use Tax Activity' box on Page 5 instead.

- Move to Part A, where you will fill out the Tax Summary by entering the Total State Sales, Total Exempt State Sales, and Taxable State Sales in the corresponding fields.

- Continue filling in the totals for sales tax, use tax, TSPLOST tax, and any other relevant tax fields. Ensure that you gather this information from your accounting records for accurate reporting.

- For Part B, enter the taxable sales amount by jurisdiction. Complete the distribution table, ensuring to classify the sales accurately to avoid any reporting errors.

- Proceed to Part C to report TSPLOST sales and use tax, only if applicable to your business operations within the specified counties.

- In Part D, calculate and record the Vendor's Compensation based on your total sales and use tax amounts.

- Complete Part E by reporting any bad debts you have incurred or recovered.

- Finally, move to Part F to certify and sign your form, acknowledging that all information provided is accurate.

- Once you have filled out the form entirely, save your changes. You can then download, print, or share the completed form as needed.

Start filling out your Georgia Sales And Use Tax Application Form online today for a seamless tax reporting experience.

Use tax is also a term commonly used to refer to the tax imposed on taxable goods and services that were not taxed at the point of sale. Use tax is imposed upon the first instance of use, consumption, distribution, or storage in Georgia of non-exempt tangible personal property purchased at retail outside of Georgia.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.