Loading

Get Pub 972

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pub 972 online

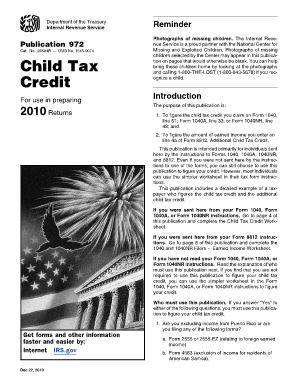

Filling out the Pub 972 is essential for calculating your child tax credit when preparing your tax returns. This guide provides step-by-step instructions to make the process efficient and straightforward, ensuring that all necessary information is accurately captured.

Follow the steps to successfully complete the Pub 972.

- Use the ‘Get Form’ button to access the form, enabling you to begin filling it out in the designated online editor.

- Read through the introductory section of the Pub 972 to familiarize yourself with its purpose and to determine if you must use it based on your specific tax situation.

- Identify any qualifying children as outlined in the publication. Ensure they meet the necessary criteria to be classified as a qualifying child for the tax credit.

- Complete the Child Tax Credit Worksheet located in the publication, starting with specifying the number of qualifying children and calculating the potential credit.

- Enter your adjusted gross income (AGI) and any exclusions related to income from Puerto Rico or other relevant sources, following the worksheet’s instructions.

- Review the worksheet’s calculations, ensuring you correctly interpret the results according to your filing status and additional credits that may apply.

- Once you have completed the worksheet, return to the main form and accurately transfer all required figures from the worksheet onto the appropriate lines.

- Upon finishing, ensure all information is accurate before saving your changes. You can then download, print, or share the completed form as needed.

Start filling out your Pub 972 online today to ensure you maximize your child tax credit.

Recent Changes to the Child Tax Credit The credit amount (per child) increased from $1,000 to $2,000. The CTC is refundable up to $1,400. It previously was not refundable. Children must have a Social Security number to qualify.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.