Loading

Get If You Qualify For An Exception 1 Through 5 (see List On - Dfa Arkansas

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the If You Qualify For An Exception 1 Through 5 (see List On - Dfa Arkansas online

This guide provides a comprehensive overview of how to complete the If You Qualify For An Exception 1 Through 5 form. Designed for users with varying levels of experience, this step-by-step process ensures clarity while navigating the required fields.

Follow the steps to successfully complete the form.

- Press the 'Get Form' button to access the document and open it in the editor.

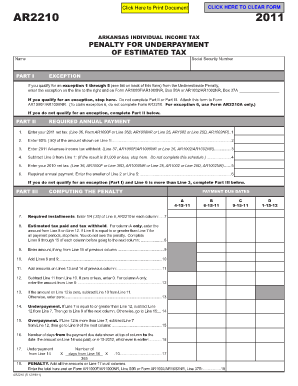

- Begin by entering your name and Social Security Number in the designated fields at the top of the form.

- In Part I, if you qualify for an exception 1 through 5, refer to the list on the back of the form and enter the applicable exception number in the specified line. If eligible, you will not need to fill out Parts II or III.

- In Part II, if you do not qualify for an exception, start with Line 1. Enter your 2011 net tax based on the appropriate form (AR1000F, AR1000NR, AR1002, or AR1002NR).

- Line 2: Calculate and enter 90% of the amount shown on Line 1 to determine your required annual payment.

- Line 3: Record the Arkansas income tax withheld from the appropriate line of the corresponding tax form.

- Line 4: Subtract Line 3 from Line 1. If the result is $1,000 or less, stop here as you do not need to complete this schedule.

- Line 5: Enter your 2010 net tax from the previous year's form (AR1000F, AR1000NR, AR1002, or AR1002NR).

- Line 6: Enter the smaller of Line 2 or Line 5—this represents your required annual payment.

- If you do not qualify for an exception and Line 6 is more than Line 3, complete Part III.

- In Part III, follow the outlined payment due dates and compute your penalty based on the underpayment from previous lines.

- Once all sections are completed, remember to save your changes, download, print, or share the form as necessary.

Complete your forms online for a seamless tax filing experience.

An Arkansas tax power of attorney form is a state-issued document that can be used to provide a tax attorney with the legal authority to represent a taxpayer in the filing of their income tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.