Loading

Get Cra Form T2125 - Statement Of Business Or Professional Activities

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CRA Form T2125 - Statement Of Business Or Professional Activities online

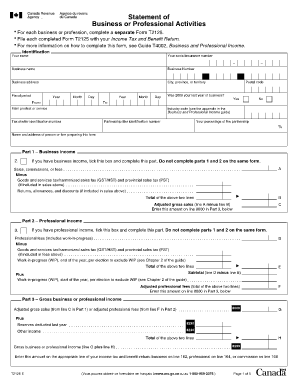

Filling out the CRA Form T2125 is essential for reporting your business or professional income. This guide will help you navigate the form step-by-step, ensuring you complete it correctly and efficiently.

Follow the steps to accurately complete the CRA Form T2125 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in your identification details. This includes your name, social insurance number, business name, business number, and business address, including city, province, and postal code. Indicate the fiscal period dates for your business activities.

- Specify if the year 2008 was your last year of business by selecting 'Yes' or 'No'.

- Enter details about your main product or service provided, the industry code, and any applicable tax shelter identification number.

- If you have business income, complete Part 1 by entering your sales, commissions, or fees. Deduct GST/HST and any returns or discounts to calculate your adjusted gross sales.

- If you have professional income, complete Part 2. Enter professional fees, subtract GST/HST, and make adjustments for work-in-progress as necessary.

- In Part 3, consolidate your gross business or professional income including reserves or other income. Calculate your total gross business income and prepare to transfer this amount to your tax return.

- If applicable, complete Part 4 for cost of goods sold, detailing your inventory, purchases, and costs associated with your business operations.

- Complete Part 5 for net income or loss before adjustments. List all business expenses and calculate your net income/loss.

- Finish up by adjusting your net income/loss in Part 6, reflecting any partnership income and business-use-of-home expenses.

- Finally, review your form for accuracy and completeness. Save changes, download, print, or share the form as necessary.

Complete your CRA Form T2125 online today for efficient and accurate reporting of your business activities.

A T2125 is a tax form you have to fill out to claim your business or professional activities, so most non-incorporated, service-based sole proprietors have to fill one out.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.