Loading

Get Invesco Solo 401(k) Distribution Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Invesco Solo 401(k) Distribution Form online

This guide provides clear and detailed instructions on how to complete the Invesco Solo 401(k) Distribution Form online, ensuring you have all the necessary information to make the process smooth and straightforward.

Follow the steps to successfully fill out the form.

- Press the ‘Get Form’ button to access the distribution form and open it in your online editor.

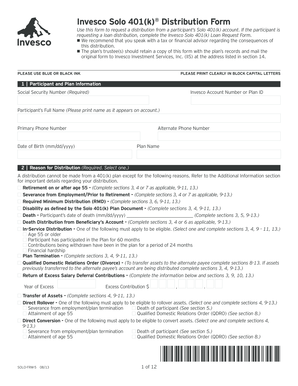

- In section 1, enter your participant and plan information, including your Social Security Number and Invesco Account Number or Plan ID. Be sure to enter your full name as it appears on your account, along with your primary and alternate phone numbers and date of birth.

- In section 2, select the reason for your distribution. You must provide a valid reason based on your eligibility, such as retirement or financial hardship.

- Complete section 3 regarding federal income tax withholding. Choose whether you want any federal income tax withheld from your distribution.

- In section 4, specify your distribution instructions. Indicate the amount you wish to distribute and select the frequency of your distribution (one-time or periodic).

- If applicable, fill out section 5 for death distribution information. Provide the necessary details about the beneficiary.

- Complete subsequent sections as required based on your specific distribution type, ensuring all necessary fields are filled out accurately.

- Once you have filled out all sections, review your form for accuracy, then save your changes, download the completed form, and print it if needed.

- Ensure to sign the form before submission, if applicable, and follow the provided mailing instructions to send the completed form to Invesco Investment Services, Inc.

Start filling out your Invesco Solo 401(k) Distribution Form online today!

Once you reach age 59 ½, you can start to take distributions from your Solo 401k with no early withdrawal penalties. To document a taxable distribution, you will need to complete and file form 1099-R. You will also need to document the distribution on your personal income taxes (generally line 16b on your form 1040).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.