Loading

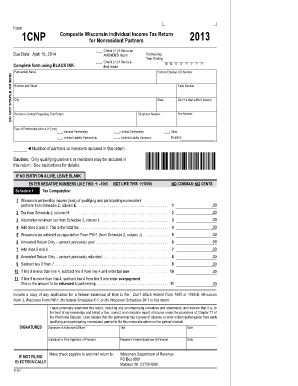

Get Form 1cnp Due Date: April 15, 2014 Check ( ) If This Is An Amended Return Complete Form Using Black

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1CNP Due Date: April 15, 2014 Check ( ) If This Is An AMENDED Return Complete Form Using BLACK online

Filling out the Form 1CNP is an essential process for nonresident partners in Wisconsin to report their income accurately. This guide provides step-by-step instructions to assist you in completing the form correctly and efficiently.

Follow the steps to fill out Form 1CNP correctly.

- Click ‘Get Form’ button to access the form and open it for editing.

- Indicate if this is an amended return by checking the box provided. If it is not an amended return, leave this box unchecked.

- Complete the basic information regarding the partnership, including the name, federal employer ID number, and the address. Ensure this is filled out in black ink.

- Specify the type of partnership by checking the appropriate box: general partnership, limited partnership, limited liability partnership, or limited liability company.

- List the number of partners or members included in this return, ensuring only qualifying partners or members are counted.

- Fill out the Wisconsin partnership income or loss section based on the relevant schedule, ensuring to leave any lines that do not apply blank.

- Calculate the total tax due as instructed, ensuring to adhere to the formatting guidelines, such as avoiding commas and only using negative indicators as specified.

- If applicable, enter the amounts related to Wisconsin tax withheld and any previous payments made for amended returns.

- Complete the signature section, ensuring that an authorized officer signs the form and that all required details are provided.

- Review the entire form for accuracy and completeness, then save the changes and prepare to download or print the completed document for submission.

Complete your Form 1CNP online today and ensure accurate filing for your partnership.

If you are filing Wisconsin Form 1, send your return to the Wisconsin Department of Revenue at: If refund or no tax due. PO Box 59. Madison, WI 53785-0001. ... If refund or no tax due. PO Box 59. Madison, WI 53785-0001. ... If tax is due or submitting Schedule CC to request a closing certificate: PO Box 8918. Madison, WI 53708-8918.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.