Loading

Get Ar1000dc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ar1000dc online

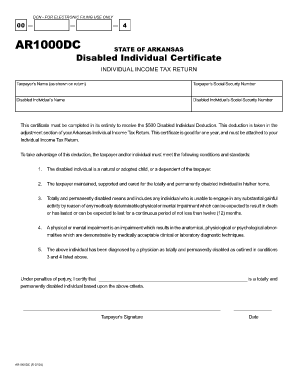

The Ar1000dc form is essential for taxpayers in Arkansas seeking a $500 disabled individual deduction on their individual income tax return. This guide will provide clear and detailed instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the Ar1000dc form online.

- Press the ‘Get Form’ button to obtain the Ar1000dc form and open it in your preferred editing tool.

- Enter the taxpayer’s name exactly as it appears on the individual income tax return. This ensures consistency in your documentation.

- Input the taxpayer’s social security number. This information is vital for identifying the taxpayer within state records.

- Provide the disabled individual’s name. This should be the name of the person who qualifies for the deduction.

- Input the disabled individual’s social security number. Ensure accuracy as this will be used for verification purposes.

- Complete the certification statement by confirming that the disabled individual meets the required conditions for being considered totally and permanently disabled.

- Sign and date the form in the designated areas to certify that all information provided is accurate to the best of your knowledge.

- Once all sections are completed, you may save changes, download the form for your records, print, or share it as necessary.

Complete your Ar1000dc form online to secure your deduction and streamline your tax filing process.

Office Contact Info OfficeAddressPhone/FaxIncome Tax Administration Individual.Income@dfa.arkansas.gov,Ledbetter Building 1816 W 7th St, Rm 2220 Little Rock, AR 72201 Mailing Address: PO Box 8110 Little Rock , AR 72203P: 501-682-1130 F: 501-682-16917 more rows

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.