Loading

Get Flood Insurance Application - Nfip

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Flood Insurance Application - NFIP online

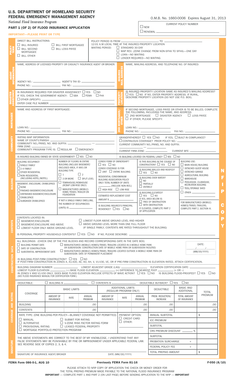

This guide provides a detailed overview of how to complete the Flood Insurance Application for the National Flood Insurance Program (NFIP) online. It encompasses essential steps, ensuring that users of all backgrounds can navigate the form efficiently.

Follow the steps to successfully complete your application.

- Press the 'Get Form' button to access the Flood Insurance Application. Carefully open the form in your editing window.

- Begin filling out the policy term section. Clearly state the period for which you require coverage, indicating the start and end dates, alongside the local time at the insured property location.

- Provide direct billing instructions as applicable. Indicate who should be billed for the policy, including options for the insured, first mortgagee, or other stakeholders.

- In the insured information section, accurately enter the name, mailing address, and telephone number of the insured party.

- Proceed to the disaster assistance query. Indicate whether insurance is required for disaster assistance and specify the applicable government agency if you answer yes.

- Fill in the property location details, ensuring that you include the name of the county or parish, community number, and panel number for accurate mapping.

- Address building data by indicating its construction type, occupancy, and features such as whether it has a basement and its current use.

- Enter estimated replacement costs for the building and any contents that require coverage.

- Sign off on the form. This includes the signature of the insurance agent or broker, along with the date of signing.

- Review the entire application to ensure all sections are complete and accurate. Finally, you can save your changes, download the application, or share it as needed.

Start completing your Flood Insurance Application online today to ensure your property is protected against flood risks.

Q: What's the main difference between NFIP and private flood insurance? A: The NFIP is a federal government program administered by the Federal Emergency Management Agency (FEMA). Private flood insurance, on the other hand, is written by private insurance carriers who are free to offer as much coverage as they want.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.