Loading

Get Asset Protection Report - Miwb Uscourts

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ASSET PROTECTION REPORT - Miwb Uscourts online

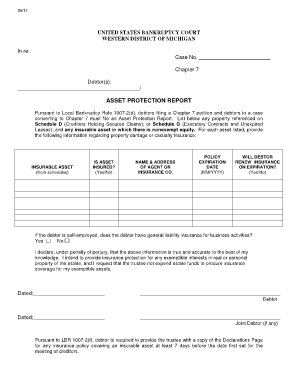

Filling out the Asset Protection Report is a critical step for debtors in Chapter 7 bankruptcy. This report helps ensure that all insurable assets are properly documented and that the relevant parties are informed about insurance coverage.

Follow the steps to accurately complete the Asset Protection Report.

- Press the ‘Get Form’ button to access the report. This will open the form in an online editor for you to fill out.

- Begin by entering the case number at the top of the form. This is important for the court's records and should match your bankruptcy case details.

- In the 'Insurable Asset' section, list any property noted on Schedule D or Schedule G. Ensure that you include details for each asset, using correct terminology.

- Next, indicate whether each asset is insured by selecting 'Yes' or 'No' in the corresponding column. This is crucial for the assessment of asset protection.

- For insured assets, fill in the name and address of the insurance agent or company providing the coverage. Accurate contact information is necessary for verification.

- Enter the policy expiration date in the format (MM/YYYY). Keeping track of expiration dates is vital to maintain coverage.

- Indicate if you will renew the insurance on expiration by selecting 'Yes' or 'No'. This helps in managing future insurance responsibilities.

- If you are self-employed, confirm whether you have general liability insurance for your business activities by choosing 'Yes' or 'No'. This ensures that business risks are accounted for.

- Complete the declaration section by signing and dating the form. You will affirm that the information provided is accurate and true to the best of your knowledge.

- Lastly, save your changes, download, print, or share the completed form as needed. Ensure that a copy of the Declarations Page for any insurance policy is provided to the trustee at least 7 days before the creditor meeting.

Take the next step by completing your Asset Protection Report online today.

ing to Michigan law, your creditor has up to 6 years (from the date of your last payment) to collect on a debt, including obtaining a judgment on the debt. By getting a judgment, your creditor can pursue collections (likely a garnishment) almost indefinitely as long as they renew the judgment every 10 years.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.