Loading

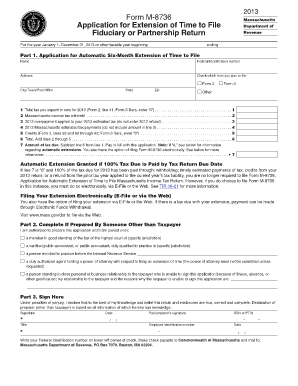

Get Credits (form 2, Lines 53 And 60 Through 62 Form 3 Filers, Enter 0) - Mass

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Credits (Form 2, Lines 53 And 60 Through 62 Form 3 Filers, Enter 0) - Mass online

Filling out the Credits section of the Massachusetts form is essential for ensuring accurate tax reporting. This guide will walk you through the necessary steps to fill out the Credits section for Form 2, Lines 53 and 60 through 62, especially for Form 3 filers, who are instructed to enter '0'.

Follow the steps to accurately complete the credits section of the form.

- Click the ‘Get Form’ button to obtain the form and open it in your online editor.

- Locate the section labeled 'Credits' on the form. This is where you will provide information related to any credits that could affect your tax liability.

- For Form 3 filers, specifically in Lines 53 and 60 through 62, you must enter '0' in the designated fields. This indicates that there are no credits to report for this tax period.

- Double-check all entered information for accuracy, ensuring that '0' is clearly recorded in the required lines.

- Once you have completed this section, proceed to review any other required sections of the form to ensure all necessary information is present.

- After completing the form, save your changes and choose your preferred option for submitting or sharing the completed document. You may also choose to download or print it for your records.

Complete your tax documents online to ensure a smooth filing process.

An individual regularly carries on a trade or business for purposes of being an eligible self-employed person if he or she carries on a trade or business within the meaning of section 1402, or is a partner in a partnership carrying on a trade or business, within the meaning of section 1402.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.