Loading

Get G E N E R A L C O R P O R At I O N Ta X Pay E R S - Nyc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GENERAL CORPORATION TAX PAYERS - NYC online

Filling out the GENERAL CORPORATION TAX PAYERS form can feel daunting, but with the right guidance, you can complete it with ease. This guide provides step-by-step instructions to help you navigate the process efficiently and accurately.

Follow the steps to fill out the G E N E R A L C O R P O R AT I O N TA X PAY E R S - Nyc.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

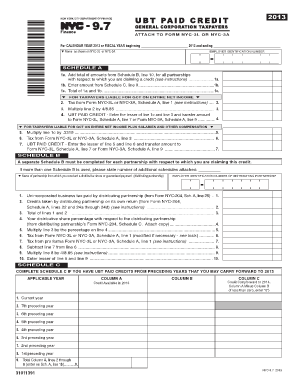

- Begin by entering the name as shown on Form NYC-3L or NYC-3A, along with your employer identification number (EIN) at the designated fields.

- Complete Schedule A by first adding the total amounts from Schedule B, line 10 for all partnerships where a credit is claimed. Enter this total on line 1a.

- Continue with line 1b by entering the amount from Schedule C, line 9 that corresponds to tax credits from previous years.

- Add the values from lines 1a and 1b, and enter the result on line 1c.

- If you are liable for GCT on the entire net income, proceed to enter the tax from Form NYC-3L or NYC-3A, Schedule A, line 1 on line 2.

- Multiply the amount on line 2 by 4/8.85, and record the result on line 3.

- For line 4, enter the lesser amount from line 1c and line 3. This amount will be transferred to Form NYC-3L Schedule A, line 7 or Form NYC-3A Schedule A, line 9.

- If additional calculations are necessary for taxpayers liable for GCT on entire net income plus salaries and compensation, complete lines 5 to 7 similarly, transferring the lesser amounts accordingly.

- Once all necessary information is filled, review the entire form for accuracy. You can then save changes, download, print, or share the form as needed.

Complete your GENERAL CORPORATION TAX PAYERS document online today for a streamlined filing experience.

New York Payroll Taxes The state as a whole has a progressive income tax that ranges from 4.00% to 8.82%, depending on an employee's income level. There is also a supplemental withholding rate of 9.62% for bonuses and commissions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.