Loading

Get Form Ma Nrcr - Mass.gov - Mass

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form MA NRCR - Mass.Gov - Mass online

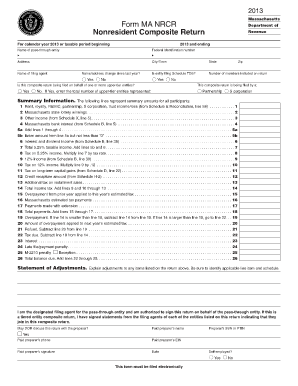

Filling out the Form MA NRCR is a crucial step for nonresidents filing a composite return in Massachusetts. This guide provides clear, step-by-step instructions to help you navigate through the form efficiently, ensuring all required information is submitted correctly.

Follow the steps to complete your form with ease.

- Press the ‘Get Form’ button to access the form. It will open in your preferred editing tool.

- Enter the federal identification number in the designated field to identify the entity filing the return.

- Provide the address, including city/town and zip code. Ensure the details are accurate to avoid processing delays.

- Indicate if there have been any name or address changes since the last filing year by checking 'Yes' or 'No'.

- Specify whether this composite return is filed on behalf of upper-tier entities. If 'Yes', state the total number of entities represented.

- For entities filing Schedule TDS, indicate 'Yes' or 'No'. This informs the Department of Revenue whether additional forms are required.

- List the number of members included on the return in the respective field.

- Identify the type of entity filing the return by selecting 'Partnership' or 'S corporation'.

- Enter summary income amounts as outlined in the fields, including rent, royalties, partnership income, Massachusetts lottery winnings, and any other relevant incomes.

- Complete calculations for the total taxable income and applicable taxes, utilizing the provided instructions to ensure accuracy.

- Once all fields are completed, review the information for accuracy. You can save your changes, download the form, print it for your records, or share it as necessary.

Complete your Form MA NRCR online today to ensure timely and accurate tax filing.

Related links form

Electronically filed (E-filed) returns take up to 6 weeks to process. Paper returns take up to 10 weeks.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.