Loading

Get W2 Reconciliation Worksheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W2 reconciliation worksheet online

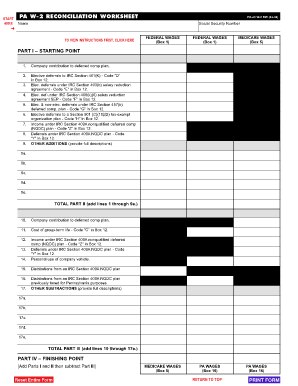

The W2 reconciliation worksheet is an essential tool for ensuring the accurate reporting of wages for Pennsylvania tax purposes. This guide provides a clear and structured approach to completing the form online, making it easier for users to understand and fulfill their obligations.

Follow the steps to accurately complete the W2 reconciliation worksheet.

- Press the ‘Get Form’ button to obtain the W2 reconciliation worksheet and access it for online completion.

- At the top of the form, enter your name and social security number for identification purposes.

- In Part I – Starting Point, fill in Federal wages from Box 1 of your W-2 in Columns A and B, and Medicare wages from Box 5 in Column C.

- Proceed to Part II – Additions. For each line (1-9e), input the amounts for various contributions and elective deferrals to the appropriate columns. Be sure to provide full descriptions where indicated.

- Calculate the total for Part II by adding lines 1 through 9e for each column.

- Next, move to Part III – Subtractions. For each line (10-17e), list the amounts corresponding to the specified deductions in the appropriate columns.

- Calculate the total for Part III by adding lines 10 through 17e for each column.

- In Part IV – Finishing Point, combine the total from Part I with the total from Part II and subtract the total from Part III. Ensure your final calculations align with the amounts on your W-2.

- Once completed, you can save changes, download, print, or share the form as needed.

Complete your W2 reconciliation worksheet online to ensure your tax reporting is accurate.

Local wages, tips, etc: The total local taxable gross pay you received. Local income tax: The total local income tax withheld from your compensation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.