Loading

Get Ls57

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ls57 online

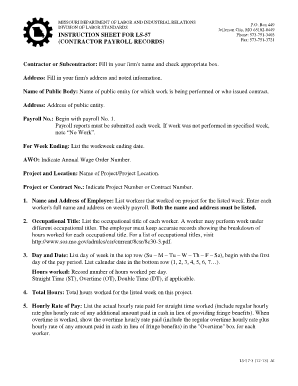

The Ls57 form, used for documenting contractor payroll records, is essential for compliance with labor standards in Missouri. This guide provides a comprehensive overview of each section to ensure accurate and complete submissions.

Follow the steps to effectively complete the Ls57 form.

- Press the ‘Get Form’ button to obtain the Ls57 form and open it for editing.

- Fill in your firm's name and check the appropriate box indicating if you are a contractor or subcontractor.

- Enter your firm's address in the designated field, ensuring all information is correct.

- Provide the name of the public body for which the work is performed, followed by their address.

- Start with payroll number 1. Remember that payroll reports must be submitted weekly. If there was no work performed in the specified week, note 'No Work'.

- Indicate the week ending date for the workweek you are reporting.

- List the Annual Wage Order number for reference.

- Detail the name and location of the project associated with this payroll record.

- Provide the project or contract number relevant to this payroll report.

- In the section for employee details, list the full name and address of each worker who performed work during this pay period.

- Record the occupational title for each worker, ensuring you keep accurate records for any multiple titles held by a worker.

- Indicate the day and date, beginning with the first day of the pay period, and fill in the number of hours worked each day, classifying as either straight time, overtime, or double time where applicable.

- Total the hours worked for the week and enter this number in the designated field.

- List the actual hourly rate paid for straight time and, if applicable, the overtime rate.

- Provide the gross amount earned for both the project and all projects combined during this pay period.

- Complete the deductions section by listing all required deductions and any others that apply.

- Enter the total amount of net wages paid for the week.

- On page two of the form, identify and list any fringe benefits provided to each employee.

- Ensure that a statement of compliance is signed by an authorized agent, affirming the accuracy of the information provided.

- Once all sections are complete, you can save your changes, download a copy, print the document, or share it as needed.

Complete your Ls57 submissions online to ensure compliance and efficiency.

The New York Wage Theft Prevention Act, passed in 2011, provides critical protections against wage theft. The protections include penalties if employers fail to provide written notice of the employee's wage rate, overtime rate, the scheduled payday, and information about the employer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.