Loading

Get Form St 102 Idaho

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form St 102 Idaho online

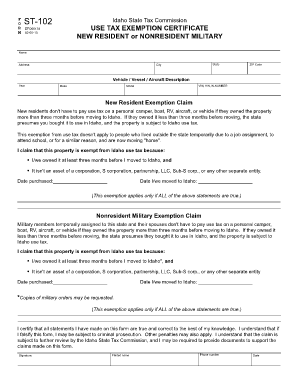

Filling out the Form St 102 Idaho is essential for individuals claiming a use tax exemption on personal property. This guide provides step-by-step instructions to help you navigate the form efficiently.

Follow the steps to complete the Form St 102 Idaho online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name in the designated field. This ensures that the form is correctly attributed to you as the applicant.

- Fill in your address, including the city, state, and ZIP code. This information allows the Idaho State Tax Commission to contact you if necessary.

- Provide a detailed description of the vehicle, vessel, or aircraft. Fill in the year, make, model, and identification numbers such as VIN, HIN, or N-number.

- Select the appropriate exemption claim type: either ‘New Resident Exemption Claim’ or ‘Nonresident Military Exemption Claim,’ based on your situation.

- Indicate the purchase date of the property and the date you moved to Idaho in the relevant fields. Ensure these dates meet the criteria for use tax exemption.

- Read the certification statement carefully, confirming that all provided information is accurate. This is crucial to avoid penalties for incorrect claims.

- Sign and print your name in the appropriate sections. Additionally, provide your phone number for any follow-up communications.

- Finally, save your changes, and options will be available for you to download, print, or share the completed form.

Complete your Form St 102 Idaho online today to ensure your use tax exemption claim is processed efficiently.

For example, Pennsylvania regulations state that sales tax exemption certificates “should” be renewed every four years.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.