Loading

Get Budget Tracker: Personal Income Statement Worksheet - Business Txstate

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Budget Tracker: Personal Income Statement Worksheet - Business Txstate online

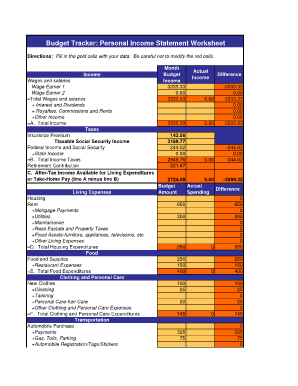

This guide provides clear instructions for completing the Budget Tracker: Personal Income Statement Worksheet - Business Txstate online. By following these steps, you will be able to accurately input your income and expenses to track your financial health effectively.

Follow the steps to fill out the Budget Tracker: Personal Income Statement Worksheet

- Click ‘Get Form’ button to access the Budget Tracker and open it in your preferred editor.

- Begin by entering your wages and salaries for wage earner 1 and wage earner 2 in the designated gold cells. Ensure that the total wages and salaries automatically calculate in the appropriate cell.

- Next, fill in additional sources of income such as interest, dividends, royalties, commissions, rents, and any other income in their respective fields. Confirm that the total income (A) is accurately reflected.

- Proceed to the tax section. Enter your taxable Social Security income and federal and state income taxes in the appropriate gold cells. Check that the total income taxes (B) calculates correctly.

- After taxes, enter your retirement contributions in the specified section. The after-tax income available for living expenditures or take-home pay (C) will automatically display as line A minus line B.

- Move on to living expenses. Input your housing costs including rent, mortgage payments, utilities, and property taxes in the designated gold cells. The total housing expenditures (D) will show your total housing costs.

- Continue with food expenditures by filling out the food and supplies and restaurant expenses. The total food expenditures (E) will reflect the aggregate of these costs.

- For clothing and personal care, list expenses such as new clothes and personal care products. The total clothing and personal care expenditures (F) will be summed up accordingly.

- In the transportation section, note all relevant expenses, including automobile purchases and fuel. The total transportation expenditures (G) will automatically calculate.

- Enter your recreation expenses such as movies, clubs, and hobbies, which will compile into total recreation expenditures (H).

- Fill out medical expenditures, noting doctor, dental, and prescription costs. The total medical expenditures (I) will total these entries.

- In the insurance section, document all insurance-related costs and see the total insurance expenditures (J) calculated.

- Lastly, record any additional expenditures, including educational costs and child care, which will total into other expenditures (K).

- Finally, calculate the total living expenditures (L) by adding lines D through K, and determine your income available for savings and investment (M). Be sure to save your changes, download, print, or share the completed form as needed.

Start tracking your budget online by filling out the Budget Tracker: Personal Income Statement Worksheet today!

Structure of Pin Code/Postal Code The first digit represents the region in India. The second digit is the sub-region, while the third digit is the sorting district. The last three digits represent the particular post office within the district.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.