Loading

Get Sample Pay Stub With Earnings Codes - Flcc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sample Pay Stub With Earnings Codes - Flcc online

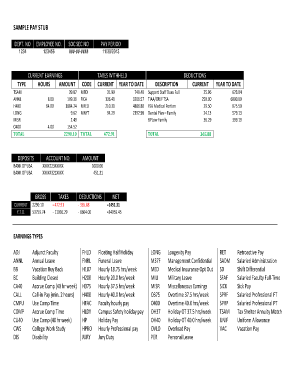

Filling out the Sample Pay Stub With Earnings Codes - Flcc can be straightforward when you understand each component of the form. This guide will help you navigate the required fields effectively while ensuring accurate documentation of your earnings.

Follow the steps to complete your pay stub accurately.

- Click ‘Get Form’ button to retrieve the pay stub form and open it in your online editor.

- Locate the 'Department Number' field and enter your department's identification number, such as '1234'.

- In the 'Employee Number' section, input your unique employee identification number, for example, '123456'.

- Fill in your 'Social Security Number' (SSN) in the designated fields, ensuring to maintain privacy. Use the format ###-##-####.

- Enter the 'Pay Period' date range accurately, ensuring it reflects the correct period, such as '11/30/2013'.

- Move to the 'Current Earnings' section and fill out the earnings types (e.g., 'TSAM', 'ANNL') along with the hours worked and amounts earned.

- In the 'Deposits' area, designate your bank account where earnings will be deposited, filling out details for 'Bank of USA' and 'Account Number'.

- Compute the applicable taxes based on your earnings and enter these figures in the 'Taxes' section.

- Complete the 'Deductions' area by specifying any deductions to be applied, such as health plans or retirement contributions.

- After entering all required information, review the entire document for accuracy to confirm all figures match your records.

- Once satisfied with the completed form, proceed to save your changes, download, print, or share the document as needed.

Start filling out your Sample Pay Stub With Earnings Codes - Flcc online today for an accurate reflection of your earnings.

What should a pay stub include? Employer information (company's name and address), Employee information (employee's name, address, ID number, and Social Security number), Reporting period and pay date, The hours worked and employee's hourly rate, Bonuses (if applicable), Total gross earnings,

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.