Loading

Get Letter Of Credit Sample

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Letter Of Credit Sample online

Filling out a letter of credit sample online is a crucial step in ensuring prompt payment and compliance with trade agreements. This guide provides comprehensive instructions for each section of the form, designed to assist users, regardless of their legal experience, in completing it accurately.

Follow the steps to successfully complete your Letter Of Credit Sample

- Click ‘Get Form’ button to access the Letter Of Credit Sample online. This action will allow you to obtain the necessary form in a format suitable for filling out.

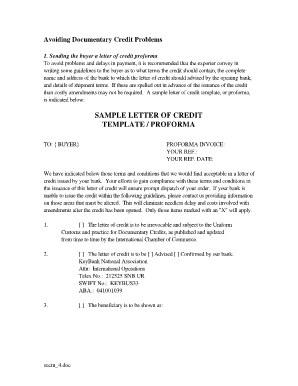

- In the designated fields, input the buyer's information, including their name and address, in the 'TO' section. This clarity is essential for directing the letter correctly.

- Complete the proforma invoice details by inserting your reference number and the date of the reference. This information helps track the correspondence related to your order.

- Indicate the terms and conditions that the buyer should adhere to when issuing the letter of credit. You can select items by marking them with an 'X'. Ensure you thoroughly review these terms to avoid any delays.

- Fill in the beneficiary's information in the appropriate section. This should reflect the entity receiving payment or the named party in the letter of credit.

- Specify the payment terms, including how and when the payment will be made. Options such as 'At sight' or after a certain number of days must be clearly defined.

- Determine the currency of the letter of credit and the specific amount. This section should strictly outline whether it will be in U.S. dollars or another currency, along with the limitations on the amount.

- List the required documents that will accompany the letter of credit. This may include commercial invoices, packing lists, and insurance certificates, among others. Be precise about any documents your entity requires.

- Specify the shipment details including the mode of transport and any conditions applicable, such as whether partial shipments or transshipments are allowed.

- Ensure to fill out the expiration date of the letter of credit and comment on any special instructions necessary for compliance or clarity.

- After completing all steps, review the form for accuracy, save your changes, and then proceed to download, print, or share the filled form as necessary.

Complete your letter of credit online to streamline your trade process today.

A Letter of Credit is an arrangement whereby Bank acting at the request of a customer (Importer / Buyer), undertakes to pay for the goods / services, to a third party (Exporter / Beneficiary) by a given date, on documents being presented in compliance with the conditions laid down.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.