Loading

Get Form St 7

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form ST-7 online

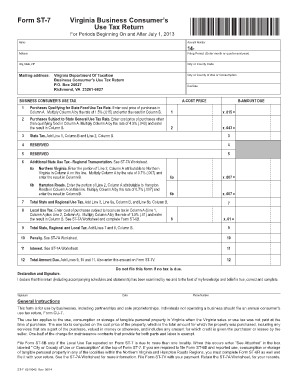

Filling out the Form ST-7 online can seem daunting, but with the right guidance, it becomes manageable. This comprehensive guide will walk you through each section and field of the form to ensure accurate and timely submission.

Follow the steps to complete the Form ST-7 online effectively.

- Click the ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter your name and account number in the designated fields. Make sure to accurately input all information to avoid processing delays.

- Provide the mailing address, including city, state, and ZIP code, to ensure that any correspondence related to the use tax can reach you timely.

- Indicate the filing period by entering the month or quarter and year for which you are filing the return.

- In the 'City or County of Use or Consumption' section, specify the local jurisdiction where the goods were used or consumed.

- For the 'Business Consumer's Use Tax' section, fill in the cost price of purchases qualifying for the state food use tax rate in Column A and calculate the amount due in Column B as per the specified rates.

- Continue entering the cost price for purchases subject to the state general use tax rate and calculate the corresponding amounts in Column B.

- Add the totals from previous calculations to fill out the state, regional, and local tax fields as instructed.

- After completing the calculations, review all entries for accuracy and completeness.

- Finally, you can save your changes, download the completed form, print it, or share it as required before submission.

Complete your Form ST-7 online today to ensure compliance and accurate tax reporting.

The current Sales Tax rate is 6.625% and the specially designated Urban Enterprise Zones rate is one half the Sales Tax rate. Certain items are exempt from sales tax, such as food, clothing, drugs, and manufacturing/processing machinery and equipment. A resale exemption also exists.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.