Loading

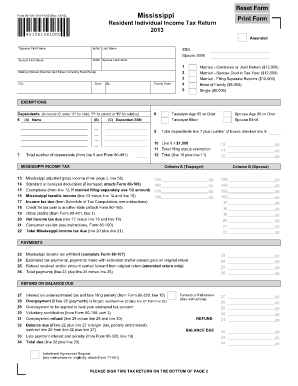

Get Form 80 105

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 80 105 online

Filling out Form 80 105 online is a straightforward process that requires careful attention to detail. This guide provides you with clear, step-by-step instructions to help you successfully complete your Individual Income Tax Return.

Follow the steps to effectively complete the form.

- Click the ‘Get Form’ button to obtain the form and open it in your online editor.

- Begin by entering your taxpayer information, including your first name, initial, and last name, followed by your spouse's details if applicable. Ensure that you also fill in respective Social Security Numbers.

- Provide your mailing address, including number and street, city, state, zip code, and county code.

- Select your filing status by marking the appropriate box for married combined, head of family, single, or married filing separately.

- List your dependents, entering their names in the specified column. In the adjacent column, denote the relationship for each dependent using 'C' for child, 'P' for parent, or 'R' for relative.

- Calculate your exemptions based on the number of dependents claimed. Enter totals as directed for both taxpayer and spouse.

- Proceed to report your Mississippi adjusted gross income, as well as any deductions applicable for your situation.

- Complete the income tax calculations by filling out the necessary fields based on your income and deductions, leading to the determination of tax liabilities.

- Review payment details, including Mississippi income tax withheld and estimated payments.

- If applicable, address refunds and any balance due by filling out the relevant sections, ensuring all calculations are accurate.

- Sign the tax return at the bottom of page 2, ensuring both taxpayer and spouse provide their signatures and necessary information.

- Finally, after reviewing your completed form for accuracy, you can save your changes. Choose to download, print, or share the form as needed.

Proceed to complete your Form 80 105 online today and ensure your tax return is submitted accurately.

Generally, you report any portion of a scholarship, a fellowship grant, or other grant that you must include in gross income as follows: If filing Form 1040 or Form 1040-SR, include the taxable portion in the total amount reported on Line 1a of your tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.