Loading

Get How Do You Fill Out A 80 160 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How Do You Fill Out A 80 160 Form online

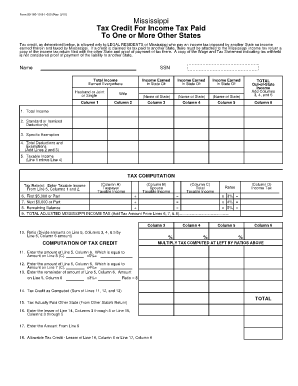

Filling out the How Do You Fill Out A 80 160 Form is straightforward when followed step-by-step. This guide is designed to assist individuals in completing the form accurately and efficiently, ensuring the correct tax credits can be claimed for income taxes paid to other states.

Follow the steps to successfully complete the form

- Click ‘Get Form’ button to access the form and open it in your designated online platform.

- Complete your personal information by entering your name and social security number. Ensure all details are accurate and match your official documents.

- Indicate your filing status by selecting the appropriate option: 'Husband,' 'Wife,' 'Joint,' or 'Single.' This information will help in computing your tax liability correctly.

- In the income columns, list your total income earned everywhere. Ensure to divide and fill in the income earned in each relevant state for each column provided.

- Calculate your total out-of-state income by adding the amounts from the sections related to income earned in other states.

- Follow the form's structure to compute your total deductions and exemptions. Begin by entering either standard or itemized deductions and specific exemptions.

- Determine your taxable income by subtracting total deductions and exemptions from your total income.

- Use the tax computation section to apply the appropriate tax rates to your taxable income as detailed. Complete each line calculating the taxes due based on the defined rates.

- Compute the tax credit by applying the ratios for tax computed against the taxable income achieved in earlier steps.

- Review the amounts on each line carefully, ensuring that you take the lesser of the allowed tax credit or the tax paid to the other state.

- Finally, summarize your total adjustments and allowable tax credit, confirming all calculations before saving, printing, or sharing the completed form.

Get started on filling your documents online today for a hassle-free process.

Reporting your interest income If you earn more than $10 in interest from a given bank, then that bank is required to provide you with a tax form summarizing your interest payments for the year. The form is called 1099-INT, and you'll either receive it in the mail or get access to it when you log into your account.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.