Loading

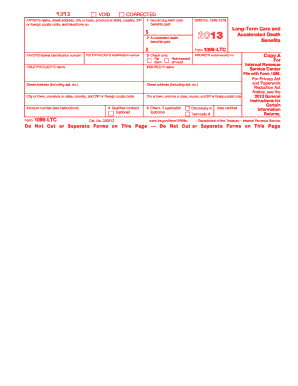

Get Form 1099-ltc - Internal Revenue Service - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1099-LTC - Internal Revenue Service - Irs online

This guide provides clear and supportive instructions on how to properly fill out Form 1099-LTC, used for reporting long-term care and accelerated death benefits. Following this step-by-step process will help ensure accurate submission of your form online.

Follow the steps to complete the Form 1099-LTC online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering the payer’s name, street address, city or town, state or province, country, ZIP code or foreign postal code, and telephone number in the designated fields.

- In box 1, input the total gross long-term care benefits paid during the year.

- In box 2, enter the total accelerated death benefits paid during the year.

- Provide the payer’s federal identification number in the specified box.

- Input the policyholder's identification number and their name in the respective fields.

- In box 3, check whether the benefits were paid on a per diem basis or were reimbursements for actual long-term care expenses.

- If applicable, indicate whether the benefits are from a qualified long-term care insurance contract in box 4.

- Complete box 5 to check if the insured is chronically ill or terminally ill, and provide the date certified.

- Once all the fields are filled, review the form for accuracy, and then save changes to download, print, or share the completed form as needed.

Complete your Form 1099-LTC online now for accurate and timely submission.

In regards to receiving LTCI benefits, benefits paid under a qualified LTCI plan are generally excluded from taxable income. The stated dollar amount of the per diem limitation (guaranteed tax free benefit, or reimbursed amount) is $400 for tax year 2021. In tax year 2020, the limit was $380.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.