Loading

Get Ac946

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ac946 online

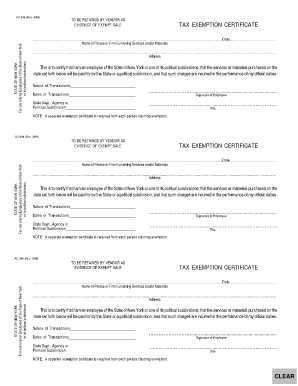

The AC946 is an essential tax exemption certificate designed for employees of the State of New York and its political subdivisions. This guide will walk you through each part of the form to ensure that you can complete it accurately and efficiently online.

Follow the steps to fill out the AC946 online correctly.

- Press the ‘Get Form’ button to retrieve the AC946 online document and open it in the editor.

- Enter the date in the designated field at the top of the form.

- Provide the name of the person or firm supplying services and/or materials in the next field.

- Fill in the address of the person or firm in the corresponding section.

- Specify the nature of the transactions that are being certified.

- Indicate the dates of the transactions in the appropriate section.

- Write the name of the State Department, agency, or political subdivision related to the transactions.

- Sign the form in the designated signature line, confirming your status as an employee.

- List your title below your signature in the space provided.

- Once all fields are filled out, you can save changes, download, print, or share the form as needed.

Complete your AC946 form online today to ensure a smooth filing process!

Related links form

To be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and. You expect to owe no federal income tax in the current tax year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.