Loading

Get 504 Schedule K-1 - The Comptroller Of Maryland

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 504 Schedule K-1 - The Comptroller Of Maryland online

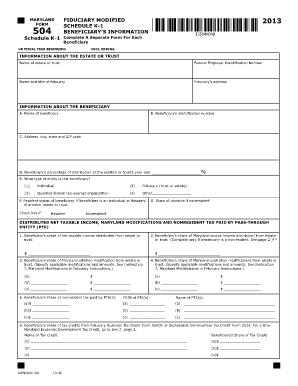

The 504 Schedule K-1 is an essential document used to report the share of an estate or trust's taxable income and modifications allocated to each beneficiary. This guide provides step-by-step instructions on how to accurately complete this form online.

Follow the steps to fill out the 504 Schedule K-1 effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the information about the estate or trust. This includes entering the name of the estate or trust, the Federal Employer Identification Number (FEIN), the name and title of the fiduciary, and the fiduciary's address.

- Provide details about the beneficiary. Enter the beneficiary’s name, identification number, address, city, state, and ZIP code. Indicate the percentage of distribution at the trust’s or estate’s year end and the type of entity for the beneficiary.

- Specify the beneficiary's resident status, checking the appropriate box if they are a resident or entering their state of domicile if they are a nonresident.

- For distributed net taxable income, enter the beneficiary’s share of net taxable income distributed from the estate or trust. If applicable, complete the sections for Maryland-source income, Maryland addition modifications, and subtraction modifications.

- If the beneficiary is a nonresident, ensure to enter the beneficiary’s share of nonresident tax paid and any tax credits from the Fiduciary Business Tax Credit Form 504CR.

- Review the entire form for accuracy. Once verified, save your changes, and you may then proceed to download, print, or share the completed form as needed.

Start filling out your 504 Schedule K-1 online today to ensure accurate reporting.

Fiduciary Filing Information Nonresident fiduciaries must also file Form 504NR which is used to calculate their nonresident tax. Fiduciary tax returns can be filed electronically.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.