Loading

Get It 1040ez 2013 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the It 1040ez 2013 Form online

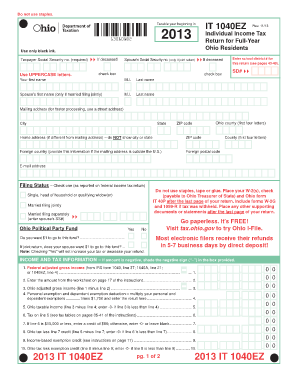

Filling out the It 1040EZ 2013 Form online is an essential step for Ohio residents to report their income and calculate their taxes accurately. This guide will walk you through each section of the form, providing clear and supportive instructions to help you complete it with confidence.

Follow the steps to complete your It 1040EZ 2013 Form online.

- Press the ‘Get Form’ button to access the It 1040EZ 2013 Form and open it in your preferred editor.

- Begin by entering your personal information. Fill in your first name, middle initial, and last name. If you are filing jointly with a partner, input their first name and Social Security number in the designated fields.

- Complete your mailing address, ensuring to include the city, state, and ZIP code. If your home address differs from your mailing address, provide this information as well.

- Check the appropriate box for your filing status from the options provided. This reflects how you are filing, such as single, married filing jointly, or head of household.

- Move on to the income section. Enter your federal adjusted gross income from your federal tax return. Follow this by entering the amount from the worksheet referenced in the form.

- Calculate your Ohio adjusted gross income by subtracting the entered worksheet amount from your federal adjusted gross income.

- Proceed to enter any personal exemptions you may have, multiplying them by the set exemption amount specified in the instructions.

- Calculate your Ohio taxable income, which is the result of subtracting your total exemptions from your Ohio adjusted gross income.

- Determine your tax liability by applying the applicable tax rate to your taxable income, as indicated in the tax tables attached to the form.

- Include any credits you qualify for, such as the income-based exemption credit or the joint filing credit if applicable.

- Assess the amount of Ohio tax withheld from your income that is reported on your W-2 forms and other supporting documents.

- Finally, review your return carefully. You can then choose to save your changes, download it, print a copy for your records, or share it as needed before submission.

Start filling out your It 1040EZ 2013 Form online today to ensure a smooth tax filing process!

File your federal tax forms online for freeYou can e-file directly to the IRS and download or print a copy of your tax return. Federal tax filing is free for everyone with no limitations, and state filing is only $14.99 $12.95.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.