Loading

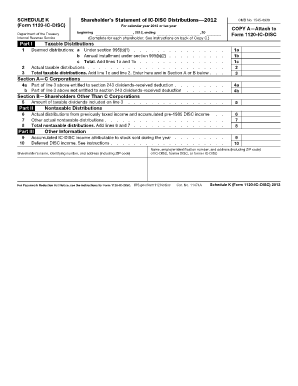

Get 2012 Form 1120-ic-disc (schedule K) - Internal Revenue Service - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Form 1120-IC-DISC (Schedule K) - Internal Revenue Service - Irs online

Filling out the 2012 Form 1120-IC-DISC (Schedule K) is essential for reporting actual or deemed distributions from International Sales Corporations. This guide provides a clear, step-by-step approach to help users navigate the form efficiently and accurately online.

Follow the steps to complete the form online successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part I, where you need to report taxable distributions. Enter the deemed distributions under section 995(b)(1) on line 1a and the annual installment under section 995(b)(2) on line 1b. Total these amounts on line 1c.

- Next, input the actual taxable distributions received during the tax year on line 2.

- In Section A for C Corporations, specify the part of line 3 entitled to the section 243 dividends-received deduction on line 4a and the part that is not eligible on line 4b.

- For all other distributions, denote the actual distributions from previously taxed income and accumulated pre-1985 DISC income on line 5.

- Continue to Part II, which covers nontaxable distributions. Report any amounts on line 6 that represent distributions from previously taxed income.

- Indicate other nontaxable distributions you may have received on line 7.

- Then, proceed to Part III where you will enter any accumulated IC-DISC income pertinent to stock sold during the year, along with any deferred DISC income as described in the instructions.

- Verify all entries and ensure the information provided is accurate and complete.

- Finally, save your changes, and use the available options to download, print, or share the completed form as necessary.

Complete your documents online today and ensure your compliance with the IRS guidelines.

Instead of forming a trust, the C corporation's U.S. owners could form an LLC to own the IC-DISC.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.