Loading

Get 14_700_sov.indd. Instructions For Form 4136, Credit For Federal Tax Paid On Fuels - Maine

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 14_700_SOV.indd. Instructions For Form 4136, Credit For Federal Tax Paid On Fuels - Maine online

This guide aims to assist users in accurately completing the 14_700_SOV.indd. Instructions For Form 4136, Credit For Federal Tax Paid On Fuels - Maine. By following these steps, users will be able to fill out the form with confidence and ensure compliance with Maine tax regulations.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor for completion.

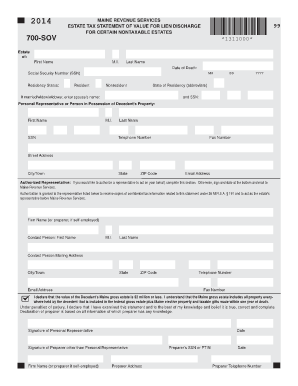

- Begin by entering the name of the estate in the designated fields, ensuring to include the first name, middle initial, and last name.

- Provide the date of death using the MM/DD/YYYY format. This information is crucial for determining tax obligations.

- Indicate the social security number of the decedent accurately.

- Check the appropriate box to note the residency status of the decedent, selecting either 'Resident' or 'Nonresident,' and enter the abbreviated state of residency if applicable.

- If married or a widow/widower, fill in the spouse’s name and social security number in the designated areas.

- Complete the section for the personal representative or person in possession of the decedent’s property, including their contact information such as telephone number, address, and email.

- If you wish to authorize a representative to act on your behalf, fill out the authorized representative section. This step is optional; if not applicable, skip to the signature area.

- Read the declaration statement carefully to ensure compliance. After verifying the information, the personal representative must sign and date the form at the bottom.

- If a preparer other than the personal representative completed the form, that individual should also sign and provide their information, including firm name and address.

- Once all sections are completed, review the document for accuracy, then save changes, download, print, or share the form as needed.

Take the next step in managing your tax documents online by completing your forms promptly.

In order to qualify for tax-free treatment, the state or local government must purchase the fuel for its own exclusive use. State and local government entities may benefit from Internal Revenue Code Section 4221(a)(4). This section exempts these entities from the Federal motor fuel excise taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.