Loading

Get 2013 Fillable K 1 Form

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2013 Fillable K 1 Form online

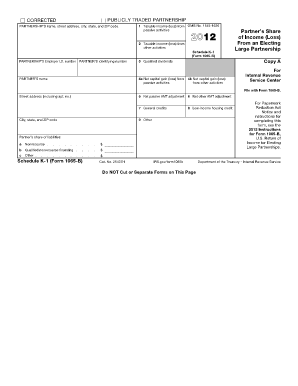

Filling out the 2013 Fillable K 1 Form online is essential for accurately reporting your share of income or loss from an electing large partnership. This guide provides step-by-step instructions to ensure that you complete the form correctly and efficiently.

Follow the steps to complete the 2013 Fillable K 1 Form online.

- Press the ‘Get Form’ button to access the form, allowing you to open it in a suitable editor.

- Begin by entering the partnership’s name, street address, city, state, and ZIP code in the designated fields.

- Input the partnership’s Employer Identification Number (E.I.N.) and your identifying number as the partner.

- Fill in line 1 with the taxable income or loss from passive activities as reported.

- Provide the taxable income or loss from other activities on line 2.

- In line 3, enter any qualified dividends you may have received.

- Complete lines 4a and 4b by entering net capital gains or losses from both passive and other activities.

- If applicable, fill in line 5 for net passive Alternative Minimum Tax (AMT) adjustments.

- Complete line 6 for net other AMT adjustments if relevant.

- On line 7, report any general credits, followed by line 8 for the low-income housing credit.

- Use line 9 to provide any other relevant information as required.

- Fill in the partnership's liabilities in the designated fields for nonrecourse, qualified nonrecourse financing, and other liabilities.

- Review your entries for accuracy, then save your changes, download, print, or share the completed form as necessary.

Complete your documents online to ensure accurate and efficient filing.

The K-1 lists distributions withdrawals from income or from your capital account that you've taken during the tax year. These distributions are not what you're taxed on. You pay tax on your share of the LLC's income, whether you withdraw it or keep it in the company.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.