Loading

Get 2013 Nyc 221 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2013 NYC 221 form online

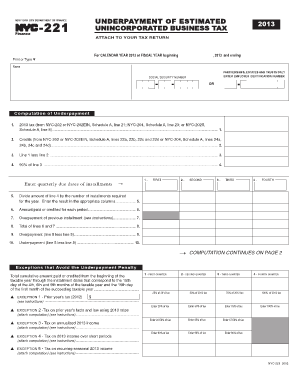

Filling out the 2013 NYC 221 Form is essential for taxpayers subject to the Unincorporated Business Tax to report their estimated tax correctly. This guide provides you with clear, step-by-step instructions to complete the form online.

Follow the steps to accurately complete the form online.

- Click ‘Get Form’ button to obtain the 2013 NYC 221 form and open it for editing.

- Enter your name in the designated field at the top of the form.

- Input your Social Security number in the appropriate section.

- For partnerships, estates, and trusts, provide the Employer Identification Number in the required area.

- Complete the 'Computation of Underpayment' section by referring to your 2013 tax from the relevant NYC tax forms.

- List the credits from the applicable schedules as instructed.

- Perform the necessary calculations to determine the lines' values, such as subtracting line 2 from line 1.

- Enter the due dates of installments for each quarter as outlined on the form.

- Document any payments made or credits used for each installment period.

- Evaluate potential exceptions that may avoid the underpayment penalty by following the instructions provided.

- Finalize calculations for penalties, if applicable, using the provided guidelines.

- Once all sections are complete, ensure that your entries are accurate. You can now save, download, print, or share the completed form as necessary.

Start completing your documents online to ensure accuracy and compliance.

Related links form

Form NYC-221 will enable taxpayers subject to the Unincorporated Business Tax to determine if they paid the correct amount of estimated tax by the proper due date. If the minimum amount was not paid timely, an underpayment penalty may be imposed for the period underpaid.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.