Get 2013 Publication 523 - Internal Revenue Service

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign 2013 Publication 523 - Internal Revenue Service online

How to fill out and sign 2013 Publication 523 - Internal Revenue Service online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Choosing a legal expert, making a scheduled visit and coming to the workplace for a private conference makes completing a 2013 Publication 523 - Internal Revenue Service from beginning to end tiring. US Legal Forms helps you to rapidly generate legally-compliant papers based on pre-constructed online templates.

Prepare your docs in minutes using our simple step-by-step instructions:

- Get the 2013 Publication 523 - Internal Revenue Service you need.

- Open it with online editor and start adjusting.

- Fill in the empty fields; involved parties names, places of residence and numbers etc.

- Change the blanks with smart fillable fields.

- Include the day/time and place your e-signature.

- Click Done after double-checking everything.

- Save the ready-made record to your system or print it out as a hard copy.

Swiftly generate a 2013 Publication 523 - Internal Revenue Service without having to involve professionals. We already have over 3 million users taking advantage of our unique catalogue of legal forms. Join us right now and get access to the #1 library of web templates. Test it yourself!

How to edit 2013 Publication 523 - Internal Revenue Service: customize forms online

Go with a rock-solid file editing option you can trust. Edit, execute, and certify 2013 Publication 523 - Internal Revenue Service safely online.

Very often, modifying documents, like 2013 Publication 523 - Internal Revenue Service, can be a challenge, especially if you got them online or via email but don’t have access to specialized tools. Of course, you can find some workarounds to get around it, but you risk getting a document that won't fulfill the submission requirements. Utilizing a printer and scanner isn’t an option either because it's time- and resource-consuming.

We offer an easier and more streamlined way of modifying files. A rich catalog of document templates that are easy to customize and certify, and then make fillable for others. Our solution extends way beyond a collection of templates. One of the best parts of utilizing our option is that you can edit 2013 Publication 523 - Internal Revenue Service directly on our website.

Since it's an online-based solution, it spares you from having to get any software program. Plus, not all company rules allow you to install it on your corporate computer. Here's how you can easily and safely execute your paperwork with our solution.

- Hit the Get Form > you’ll be immediately redirected to our editor.

- As soon as opened, you can kick off the editing process.

- Choose checkmark or circle, line, arrow and cross and other options to annotate your document.

- Pick the date field to add a particular date to your document.

- Add text boxes, graphics and notes and more to complement the content.

- Use the fillable fields option on the right to create fillable {fields.

- Choose Sign from the top toolbar to generate and create your legally-binding signature.

- Click DONE and save, print, and pass around or get the output.

Say goodbye to paper and other inefficient ways of modifying your 2013 Publication 523 - Internal Revenue Service or other files. Use our solution instead that combines one of the richest libraries of ready-to-customize templates and a powerful file editing option. It's easy and safe, and can save you lots of time! Don’t take our word for it, give it a try yourself!

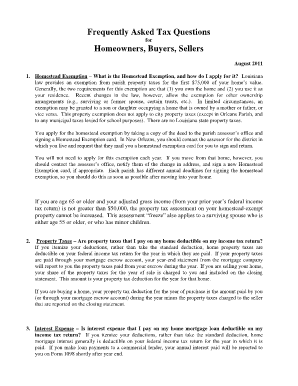

A second home, or a timeshare, used as a vacation home is a personal use capital asset. A gain on the sale is reportable income, but a loss is NOT deductible. You may receive IRS Form 1099-S Proceeds from Real Estate Transactions for the sale of your vacation home.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.