Loading

Get Freddie Mac Form 91 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Freddie Mac Form 91 2020 online

Filling out the Freddie Mac Form 91 2020 online can be a straightforward process if approached step by step. This guide aims to provide you with clear instructions to help you accurately complete the form, ensuring you understand each component involved.

Follow the steps to successfully complete the Freddie Mac Form 91 2020.

- Click ‘Get Form’ button to obtain the form and access it for completion.

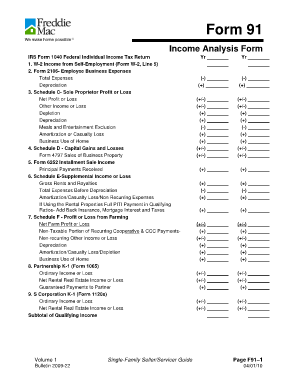

- Begin with Section 1, where you input W-2 income from self-employment. Ensure only to include income from self-employment and not from other sources.

- In Section 2, report employee business expenses from Form 2106. Deduct all paid business expenses and add back depreciation if applicable.

- For Section 3, include any continuing income or loss from sole proprietorship as outlined in Schedule C. Document this income accurately.

- Section 4 requires reporting capital gains and losses only if they are recurring and consistent over a two-year period; ensure you have documentation to support these figures.

- In Section 5, enter income from Form 6252, but only if installment payments have been received for at least one year and relevant agreements are in the mortgage file.

- Section 6 involves calculating supplemental income or loss. This is where you summarize continuing rent and royalty income.

- Section 7 is for detailing profit or loss from farming. Use the net farm income along with the necessary allowances.

- For Sections 8 and 9, report partnership and S-Corporation K-1 incomes, but ensure all supporting documents that prove access to these incomes are present.

- Lastly, summarize any additional corporation income in the subsequent sections, ensuring you adhere to all documentation requirements.

- Once all sections are complete, review your entries carefully for accuracy. You can then save your changes, download, print, or share the form as needed.

Start completing your Freddie Mac Form 91 2020 online today for a seamless documentation experience.

Form 91 is to be used to document the Seller's calculation of the income for a self-employed Borrower. ... This form does not replace the requirements and guidance for the analysis and treatment of the income for self-employed Borrowers as described in Chapters 5304 and 5305.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.