Loading

Get Release Of Debt

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Release Of Debt online

Filling out the Release Of Debt form online is a crucial step in the process of settling a debt that has been secured by a Deed of Trust. This guide provides clear and supportive instructions to help you successfully complete the form with ease.

Follow the steps to complete your Release Of Debt form online.

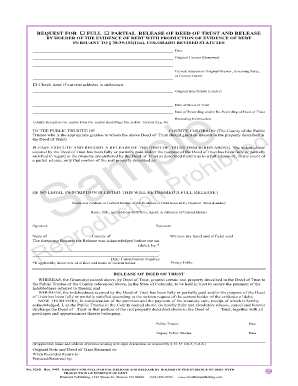

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the date at the top of the form to indicate when you are submitting the release request.

- Fill in the name of the original Grantor (Borrower) and their current address. If the current address is unknown, be sure to check the corresponding box provided.

- Provide the name of the original Beneficiary (Lender) and the date the Deed of Trust was established.

- Include the recording date and any relevant recording information such as County Reception Number or Book/Page Number.

- Specify the county where the Public Trustee is located, as they are responsible for processing your request.

- Indicate whether the indebtedness has been fully or partially paid and note the portion of property being released if applicable.

- Write the name and address of the current holder of the Evidence of Debt Secured by the Deed of Trust.

- Provide the name, title, and address of the officer, agent, or attorney of the current holder.

- Ensure to include the signatures of the current holder and any necessary representatives.

- In the acknowledgment section, include the state and county where the request is acknowledged, along with the date.

- Finally, review all entries for accuracy. Then, save your changes, download, print, or share the completed form as needed.

Complete your Release Of Debt form online today for a smooth and efficient process.

Debt forgiveness is when a creditor cancels some or all of your outstanding debt. But there's always a catch. Creditors won't erase your debt just because you ask, and debt forgiveness options can be loaded with traps such as hard-to-follow rules, unexpected tax bills and damage to your credit scores.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.