Loading

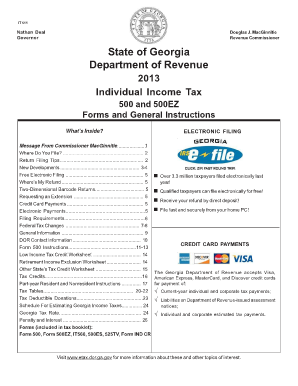

Get 500 Ez Instructions 2013 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 500 Ez Instructions 2013 Form online

This guide provides clear, step-by-step instructions for completing the 500 Ez Instructions 2013 Form online. Designed for users with varying levels of experience, it aims to ensure a smooth filing process while maximizing accuracy and efficiency.

Follow the steps to complete the form accurately.

- Click the 'Get Form' button to obtain the 500 Ez Instructions 2013 Form and open it in your preferred online document editor.

- Begin by entering your personal information in the designated fields. Ensure that you accurately provide your name, address, and Social Security number.

- Select your residency status from the options provided. If you lived in Georgia for the entire year, indicate '1'; if part of the year, select '2' and specify the dates; and if a non-resident, choose '3'.

- Choose your filing status as per your Federal return. Use the appropriate letter from the options provided that matches your filing status.

- Fill in your Federal adjusted gross income (AGI) in the specified field. Make sure it matches your Federal return.

- Complete the sections for deductions, exemptions, and credits as applicable to your situation. Be sure to reference any necessary worksheets provided with the form.

- Review and double-check all entries for accuracy, including calculations and any additional documentation required to support your claims.

- Once complete, you will have the option to save your changes, download the document, print it for your records, or share it with a tax professional if needed.

Start filling out your 500 Ez Instructions 2013 Form online today for an easier tax filing experience.

1. YOU MAY USE FORM 500EZ IF: You are not 65 or over, or blind. Your filing status is single or married filing joint and you do not claim any exemptions other than yourself or yourself and your spouse. Your income does not exceed $99,999 and you do not itemize deductions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.