Loading

Get Form 3m

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 3m online

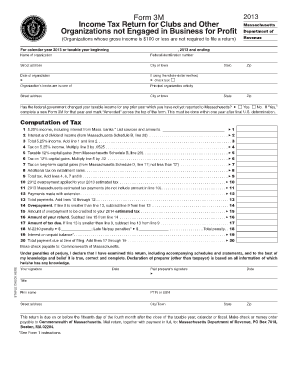

This guide provides clear and detailed instructions for filling out the Form 3m online, specifically designed for clubs and organizations not engaged in business for profit. By following these steps, users can efficiently complete their income tax return, ensuring compliance with Massachusetts tax requirements.

Follow the steps to complete your Form 3m online.

- Press the ‘Get Form’ button to download the Form 3m and open it in your online editor.

- In the first section, provide the name of the organization along with its federal identification number. This information is critical for identifying your organization.

- Fill out the date of organization and check the box if using the whole-dollar method for reporting. This step is important for accurate income reporting.

- Enter the street address, city or town, state, and zip code of your organization. Ensure these details are correct to avoid mail delivery issues.

- Indicate if the federal government has changed your taxable income for any prior year by answering 'Yes' or 'No'. If yes, additional steps are required.

- Proceed to the computation of tax section. Here, input your 5.25% income amounts and list the sources as necessary. Be attentive to correctly calculate your total income.

- Calculate the tax based on your income, including interest and dividends as indicated on the form. Accurate calculations are key to filing your tax return.

- Review all calculations and sections filled out, ensuring no fields are left incomplete. Double-check your entries for precision.

- Once complete, you can save your changes, download a copy of the filled form, print it for your records, or share it as needed.

Complete your Form 3m online today and ensure your organization meets its tax obligations.

A taxpayer has to compulsorily file ITR-3 online. The ITR-3 can be filed online/electronically: By furnishing the return electronically under a digital signature. By transmitting the data electronically and then submitting the verification of the return in Form ITR-V.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.