Loading

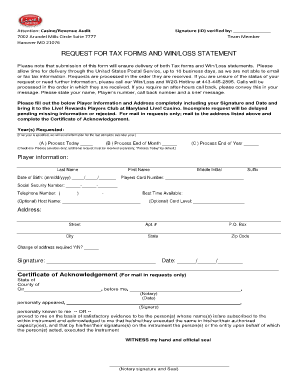

Get Maryland Live Win Loss Statement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Maryland Live Win Loss Statement online

The Maryland Live Win Loss Statement is essential for reporting your gaming activity for tax purposes. This guide provides clear and supportive instructions on how to complete the statement online, ensuring you accurately submit your information.

Follow the steps to complete your Win Loss Statement electronically.

- Click ‘Get Form’ button to obtain the document and open it in your preferred editing tool.

- Begin by filling in the Player Information section. Provide your last name, first name, middle initial, suffix, and date of birth in the specified format (mm/dd/yyyy).

- Enter your Players Card Number and Social Security Number. Ensure that these numbers are correct to avoid delays in processing.

- Provide your telephone number and indicate the best time to reach you. You can also optionally include a Host Name and Card Level if applicable.

- Fill out your address details completely, including street, city, apt number, P.O. Box (if any), state, and ZIP code. Indicate if a change of address is required.

- Sign the form and include the date of your signature at the designated area.

- If mailing your request, be aware that you may need to complete the Certificate of Acknowledgment section. Ensure it is notarized as required.

- Review your entries to confirm that all information is accurate and complete. Incomplete forms may be delayed or rejected.

- Once you have verified all information, save your changes. You may then download, print, or share the completed form as needed.

Ensure your gaming activity is properly documented by completing your Maryland Live Win Loss Statement online today.

A W2-G is an official tax document that is issued for individual jackpots and other gaming winnings over a certain amount; you should be given a copy of this form at the time the winnings are awarded. This is not the same as an annual win/loss statement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.