Loading

Get St 100 913 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St 100 913 Form online

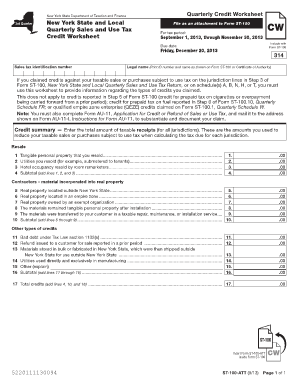

Filling out the St 100 913 Form online is essential for users seeking to claim tax credits effectively. This guide will navigate you through each step, ensuring you have all the necessary information to complete the form accurately.

Follow the steps to fill out the St 100 913 Form online.

- Click ‘Get Form’ button to access the St 100 913 Form and open it in your preferred online editor.

- Locate the sales tax identification number field and input your unique number as issued by the state. This number is crucial for proper identification.

- In the legal name section, print your name and the ID number exactly as shown on your Form ST-100 or Certificate of Authority. Ensure accuracy to avoid processing delays.

- For each credit claimed against taxable sales or purchases, provide detailed information based on the corresponding sections of Form ST-100. Input the amounts in the designated spaces clearly.

- Calculate and enter the subtotal for related lines to ensure that columns reflect the correct total credits for resale, personal property, and other types of credits.

- Once all relevant information has been entered and reviewed, proceed to save your changes securely. You may choose to download or print the document for your records.

Finalize your submission by completing the St 100 913 Form online today.

Log in to (or create) your Business Online Services account. Select the ≡ Services menu in the upper-left corner of your Account Summary homepage. Select Sales tax - file and pay, then select Sales tax web file from the expanded menu.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.