Loading

Get Surplus Lines Statement (form Sl-8) State Of Connecticut Insurance Department (rev

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Surplus Lines Statement (Form SL-8) State Of Connecticut Insurance Department (Rev online

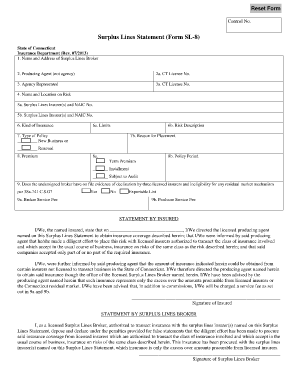

The Surplus Lines Statement (Form SL-8) is an essential document for surplus lines insurance transactions in Connecticut. This guide provides step-by-step instructions on how to accurately fill out the form to ensure compliance with state regulations.

Follow the steps to complete the form accurately.

- Click 'Get Form' button to obtain the Surplus Lines Statement (Form SL-8) and open it for editing.

- Begin by entering the name and address of the surplus lines broker in the designated field.

- Provide the name of the producing agent in the next field, along with their Connecticut license number.

- Input the name of the agency represented and the corresponding Connecticut license number.

- Detail the name and location of the risk in the appropriate section.

- Identify the surplus lines insurer(s) involved and enter their NAIC numbers, listed under fields 5a and 5b.

- Specify the kind of insurance being provided in field 6, and complete the limits (6a) and risk description (6b) by describing the operation or risk type.

- Indicate whether it is new business or a renewal in field 7, along with the reason for placement in field 7b.

- State the premium in field 8 and specify the payment terms in 8a and the policy period in 8b.

- Answer question 9 by selecting 'Yes' or 'No' and provide the amounts for the broker service fee (9a) and the producer service fee (9b).

- Ensure to assign the control number in numerical sequence, followed by the last two digits of the year of the policy effective date.

- Both the insured and the surplus lines broker must sign the statement.

- Once completed, save your changes and proceed to download, print, or share the form as needed.

Complete your Surplus Lines Statement (Form SL-8) online today for efficient document management.

A: Every surplus line broker must make an annual state tax filing. The amount of state tax is 3% of the California taxable surplus line premium transacted by the broker, for California home state insureds, from January 1st to December 31st of the previous year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.