Loading

Get Form 01 922

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 01 922 online

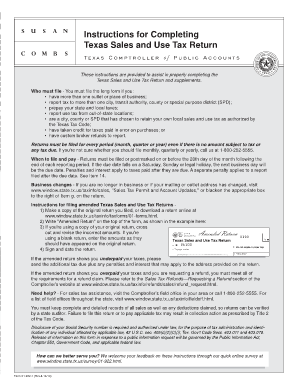

Filling out the Form 01 922 is essential for proper reporting of sales and use tax in Texas. This guide provides clear and concise instructions for completing the form online, ensuring users can confidently submit their returns.

Follow the steps to successfully complete the Form 01 922 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your taxpayer number as shown on your sales tax permit. If you are a sole owner without a permit, use your Social Security number instead.

- Specify the filing period by entering the month, quarter, or year for this report and the last day of the reporting period.

- In Column 1, list all cities, counties, and special purpose districts where you conducted business during the reporting period.

- Fill in Column 2 with the seven-digit local codes for the jurisdictions listed in Column 1. These codes are essential for accurate reporting.

- In Column 3, report the total amount subject to tax, which includes taxable sales and purchases for each jurisdiction listed.

- Document the local tax rate for each jurisdiction in Column 4, referencing current rates if necessary.

- Calculate the tax due in Column 5 by multiplying the total from Column 3 by the respective tax rate from Column 4.

- Review all entered information for accuracy, making necessary corrections.

- Once completed, save your changes, and consider downloading, printing, or sharing the form as needed.

Complete your Form 01 922 online to ensure compliance and streamline your tax reporting process.

You will need to apply using form AP-201, Texas Application (PDF). Email the application to sales.applications@cpa.texas.gov or fax the application to 512-936-0010. To complete the application, you will need the following documentation: Sole owner's Social Security number.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.