Loading

Get Wyoming Quarterly Ui Wc Summary Report Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wyoming Quarterly Ui Wc Summary Report Form online

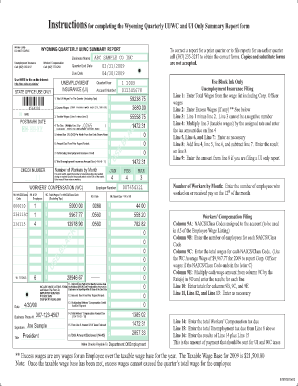

Completing the Wyoming Quarterly UI/WC Summary Report Form is essential for reporting unemployment insurance and workers' compensation details. This guide will provide clear, step-by-step instructions to help users fill out this important form online, ensuring compliance and accuracy.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the appropriate editor.

- Fill in the business name, quarter end date, and due date at the top of the form. Ensure the dates are accurate to avoid delays in processing.

- Provide the total UI wages for the quarter, including tips, in the designated field. This total reflects the wages paid to all employees.

- If applicable, enter any excess wages above the taxable wage base. For 2009, this amount is $21,500.

- Calculate taxable wages by subtracting excess wages from the total UI wages, and enter the result.

- Calculate the tax due by multiplying the taxable wages by the assigned rate, including the employment support fund percentage.

- Include any interest due for late payments, calculated as 2% per month from the due date.

- Sum any amounts due from prior report periods and any outstanding unemployment insurance credits.

- Total all calculated amounts for UI by following the formula indicated in the form, ensuring everything is accurately summed.

- For the workers' compensation section, fill in the NAICS/class code, number of employees, total wages per class code, and apply the corresponding rate.

- Calculate the total amounts due for workers' compensation in the same manner as UI.

- Review all entries for accuracy, ensuring that no fields are left blank unnecessarily.

- Once completed, save changes, and choose to download, print, or share the form as needed for submission.

Complete your Wyoming Quarterly UI/WC Summary Report Form online today to ensure timely and accurate reporting.

Name, address, and phone number for your most recent employer. Date of the last day you worked. For any work completed outside of Wyoming over the previous 18 months, contact information and dates for those employers and periods of work. Your Social Security number.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.