Loading

Get St 16tel Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St 16tel Form online

Filling out the St 16tel Form online is a straightforward process that can help streamline your sales tax reporting. This guide will provide you with clear, step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to fill out the St 16tel Form correctly.

- Click ‘Get Form’ button to access the St 16tel Form and open it in your online editor.

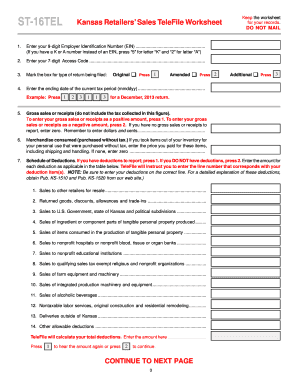

- Begin by entering your 9-digit Employer Identification Number (EIN) in the designated field. If you have a K or A number, substitute 'K' with '5' and 'A' with '2' during input.

- Next, input your 7-digit access code, which is provided on your Sales Tax Rate Change postcard.

- Mark the appropriate box to indicate the type of return you are filing: original, amended, or additional.

- Enter the ending date of the current tax period using the format mmddyy.

- Report your gross sales or receipts excluding tax collected, ensuring you enter it as a positive amount if applicable.

- If applicable, enter the value of any merchandise consumed that was purchased without tax.

- If you have deductions to report, indicate that by pressing the corresponding number and enter the amount for each deduction type as instructed.

- After entering the information, the online system will calculate your net sales and net tax. Enter these amounts as prompted.

- If you received a credit memo, enter the amount or zero if not applicable.

- Enter your banking details: specify checking or savings account and input your account number along with the 9-digit routing number.

- Review the total amount due as calculated by the system and confirm the payment method.

- Finally, remember to obtain the 12-digit confirmation number provided by the system before completing the submission process. Do not terminate the session without it.

- Once all required fields are filled, save your changes, and download or print the completed form for your records.

Complete your St 16tel Form online today to ensure timely filing and avoid penalties.

In general, you need a sales tax permit in Kansas if you have physical presence or meet economic nexus requirements. For more detailed information on the necessity of getting a permit, you can learn more at our blog post “Do You Need to Get a Sales Tax Permit in Kansas?”

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.